Opinion: Taxes on GPT Earnings

Attribution: N/A (Public Domain)

Before we get into this topic (note that I’ve classified this blog post

as an Opinion, not Advice), let me first say that I am not a tax professional.

I am not a tax attorney, certified financial accountant, tax preparer or any

other type of tax expert. Therefore, please do not take the following information

as gospel and before you make a tax decision, please check with your tax

professional.

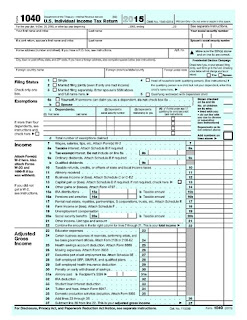

That being said, a common question I see many people having around March

and April is whether they need to pay taxes on their GPT earnings. The simple

answer is that yes, you need to pay incomes taxes on those gift cards you’re

getting from Perk or Swagbucks. But the reality is that very few people using

GPT sites or apps will pay any income tax on their earnings. But why is that?

What’s Taxable?

From the IRS’ point of view, pretty much anything you earn is taxable,

unless otherwise excluded. And yes, that includes the money and benefits you

earn from GPT sites. But whether the IRS learns of the this income is another

question.

Do GPT Sites Report My Earnings?

Yes and no. The official word from Swagbucks

is no, they don’t send anything to the IRS, unless you win a sweepstakes prize

worth more than $600. Why this is the case, I don’t know. I’ve read one theory

stating that Swagbucks is classified as a rebate or cash-back site (like

Ebates), so they’re not in the (primary) business or helping users generate

income. It makes sense, I suppose.

EarnHoney and Perk supposedly ask users to submit tax information if

they redeem $600 or more (or maybe it’s “more than $600,” I’m not sure. It only

matters if you make exactly $600, though). And I have no idea what happens if

you ignore their request for tax information. Probably the worst thing they

could do is ban you and therefore make you forfeit whatever rewards you haven’t

redeemed yet.

If I Pay Taxes on GPT Income,

Can I Deduct the Costs Incurred to Earn that Income?

I would think so. The cost of that new phone, tablet or laptop you use

exclusively for GPT sites should be a deductible business expense if you’re

paying income taxes on your GPT income, right? I assume so, but again, I’m not

a tax expert. However, if you’re paying taxes on your GPT earning, you

certainly should ask your tax professional this question.

Conclusion

I’m not going to into how to avoid paying taxes on your GPT earnings,

but I will make the following observations and comments from my online research:

- When it comes to GPT sites (and other

businesses for that matter) reporting income to the IRS, $600 seems to be

a magical threshold.

- If GPT Site A and GPT Site B have a $600

threshold for generating a 1099 tax document and you make $800 with GPT

Site A, you’re getting a 1099 and paying taxes on your $800. But if you make

$400 with GPT Site A and $400 with GPT Site B, no 1099 should be

generated. This is assuming GPT Site A and B are separate companies, of

course.

- PayPal also has a threshold when it comes

to generating a 1099 or other necessary tax forms. I believe it’s $20,000

and 200 transactions in a calendar year. I don’t know how GPT payments

sent to your PayPal account works in regard to this threshold, but that’s

something to consider.

- Even if you don’t exceed the $20K and 200

transaction threshold for PayPal, some states may still obtain PayPal

transaction information. I believe Vermont and Massachusetts are two such

states. Source

1 and Source

2.

Comments

Post a Comment